Flippa is one of the most popular marketplaces for buying and selling online businesses. This guide will teach you how to find lucrative websites, buy them, grow them, and then eventually sell them for profit.

So, if you are wondering how to buy a website, here is our guide:

How to buy an undervalued business on Flippa.com

Time to read: 24 minutes

Decide on the type of online business you are interested in

Do you have the time to actively manage the business you are buying? Or do you rather want to passively scale it? Our preference is to buy older, rather established websites that have been neglected by their owners. They should have a good SEO position and receive good organic traffic, they have a customer purchase history, but are slightly outdated.

For us, it is ok if the design is slightly outdated as long as the underlying technology is popular and you easily find good developers for it. My strong preference here is WordPress. More than 37% of all websites run on it (crazy right?), the core technology is PHP and you can easily extend and scale it.

Additionally, we prefer businesses with limited to no offline operations. This means that for eCommerce, we would only accept a website that sells digital goods. Drop-shipping got too competitive and has no unique advantage over other sellers.

However, content websites in comparison can be great if you like the market they are in. They usually have low overhead and provide their insights to readers even when you sleep.

Lastly, it’s up to your preference though. And don’t get in a rush. Analyze dozens or even hundreds, before you decide to invest. And don’t invest in a business, which you do not fully understand.

Look for businesses with a minimum age of 2-3 years

In recent days more and more scammers have shown up on various marketplaces. They quickly build a website, build (partially even fake) traffic and aim to get rid of it quickly. The good thing?

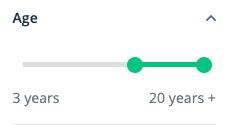

Flippa’s search allows you to filter by age:

Understand how to calculate the value of the website you look at

In short, we recommend looking at the monthly net revenues a business generates and multiply them by a maximum of 30x. While multiples have gone up in recent months, we wouldn’t invest much more. Read our detailed article here to understand how to value an online business.

In your search filter, define the monthly profit based on your multiple

For example, if you are willing to invest $20,000 to buy a website, divide that $20,000 by 30x (the max. net revenue multiple you are willing to pay). This equates to a monthly profit of approx. $666. Put simply, the websites you look at in your due diligence should at least have a monthly net profit of $666. Everything higher than this is in your favor. Everything lower hurts your valuations and extends the time until you get your investment back.

Look for a business you can run and grow mostly on your own

Start your search, but focus on niches where you have a basic understanding of and more importantly interest in. You will spend your time with this – so choose carefully.

And also, as we recommended above, try to avoid offline operations. If you need to ship parcels around the country your scalability is limited. If you ship digital products, it isn’t.

Understand the risks

Try to balance fear and determination. Being too cautious in assessing the risk doesn’t help – being to bold neither.

We recommend to look at technology, traffic and legal risks. A few guiding questions: do you understand the technology the business is built with or have someone who can help you out? Does the traffic depend on only a few traffic sources, which might break at one point? Are you in a legally troubling environment / annoy competitors, are using a trademarked name?

Be patient

As Warren Buffet’s famous partner Charlie Munger said: “it’s waiting that helps you as an investor, and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that”.

Only a handful of the business you will come across are actually of good quality – while a lot of other ones are scams. Start by creating your deal flow streams and start training your due diligence muscles.

How to automate your deal flow & due diligence?

Have a look at this video by Ahrefs on how to use an automated Scraper for this.

Move quickly when you have found a promising deal

When you have identified a business with a valuation you like, move quickly. Reach out to the seller and ask the right questions.

We always start by asking for Google Analytics’ view-only access to have a deeper look at the traffic. Do they make sense? Are they inflated? Read my article on how I nearly lost $10,000 with fake traffic.

Then we go deeper by analyzing the revenue sources (e.g. with screenshots, screen shares). We visit the website and play around, we read any comments to see whether they make sense. Good due diligence can be quite complex depending on the type of business you look at. If you need help with your due diligence, reach out to us.

Use an escrow service to conduct the purchase

When buying a website, it is hard to guarantee that you’re getting what you pay for. The so-called escrow process protects you, as the buyer to ensure that you can review the assets and confirm that they are as described before the funds are actually released to the seller.

The good thing: your funds are not released until you are fully satisfied with the assets you have received and you have notified Escrow.com to release your money – unless the inspection period (we recommend a minimum of 7 days) has ended without a response. If the assets are not as agreed upon, a resolved dispute will lead to a refund of Escrow.com to you.

Congrats! If everything went well you are now the owner of a new and hopefully growing business. Good luck on your journey and let us know if you have any questions.

Ah, and the last thing you should keep in mind or at least think about: should you buy only the assets or the whole company? If you acquire a small website that might not be too relevant yet, but still. Knowledge is better than ignorance when it comes to those types of topics.

Leave a Reply